Executive Summary

- After a difficult year in 2009 caused by the global economic crisis, the Southern Cone unified communications (UC) and collaboration solutions market resumed growth in 2010.

- Growth in 2011 is expected to be xx.x percent. Some of this will be attributed to price increases in Argentina.

- UC client and enterprise video segments were the most dynamic.

- The competitive structure is dominated by major multinational vendors.

- Chile is more advanced in the use of these applications, but Argentina is the bigger market in the region.

- Extensive adoption of Internet protocol (IP) telephony will drive the market for more advanced solutions, such as video, unified messaging, and UC.

- Traditional telephony is still growing. Poor IP infrastructure will sustain the segment.

- During 2012–2017, the market will grow between xx percent and xx percent year over year, largely because of the adoption of video by large companies, UC by mid-size companies, and IP telephony by small ones.

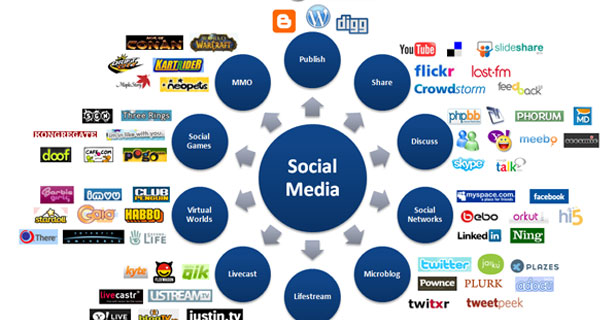

The key application segments and enabling platforms that form the total UC framework include:

Enterprise telephony (traditional telephony, IP telephony, IP softphones, and desk phones)

- Enterprise telephony includes private branch exchange (PBX), IP private branch exchange (IP PBX) systems, and IP hard phones and softphones. Enterprise telephony also includes voice gateways sold with telephony solutions.

- On-premises e-mail includes enterprise server-side and client-side software for personal computer (PC) desktops. IBM Lotus Notes/Domino, Microsoft Exchange/Outlook, and Novell GroupWise are examples of on-premises enterprise e-mail platforms. These vendors also provide Web and e-mail clients for mobile devices.

- For market sizing, this study takes the average price of an e-mail seat to include client-access licenses and other server software costs for the maintenance of existing seats, new licenses, and upgrades. The seat count does not include free e-mail seats or consumer e-mail.

- Unified messaging includes applications integrating the storage and accessibility of voice, fax, and e-mail messages to a single mailbox that can be accessed through e-mail, telephone, Web browser, or a UC client.

- Is the market growing? How long will it continue to grow, and at what rate?

- Is this an industry or a market? Will these companies/products/services continue to exist, or will they get acquired by other companies? Will the products/services become features in other markets?

- Which technology trends will affect the unified communications market?

- Are the products/services offered today meeting customer needs or is additional development needed?

- Are the vendors in the space ready to offer new services and integrate them into a new platform?

- Cost and productivity: Cost cutting and improved productivity needs will increase demand.

- Economic: The region has a relatively stable market, making long-term investment possible.

- Lack of interoperability: End users are wary of deploying new capabilities that do not work properly with their existing infrastructure.

- Mobility: The popularity of mobile devices will drive integration with other collaborative tools.

- Unclear return of investment: End users are finding it difficult to justify UC investments.

- Video and collaboration solutions integration: A main driver for future adoption.

- IP Infrastructure: Proper IP infrastructure is being deployed, and many companies are not sure of the benefits of migration.

- Unclear return of investment: End users are finding it difficult to justify UC investments.

- Lack of interoperability: End users are wary of deploying new capabilities that do not work properly with their existing infrastructure.

8:19 AM

8:19 AM

Unknown

Unknown